How to compete in a low-inventory market: Tips for North Carolina homebuyers

The North Carolina real estate market has had its share of ups and downs in recent years. From the 2008 market crash to the COVID-19 housing rush to a continued low-inventory market, buying a home today can come with extra challenges. Across the greater Triangle area, low inventory and strong demand mean buyers face steep competition, multiple-offer situations, and rising prices. To remain competitive, the following tips for North Carolina homebuyers can help you successfully compete in today’s low-inventory market.

What’s happening in North Carolina

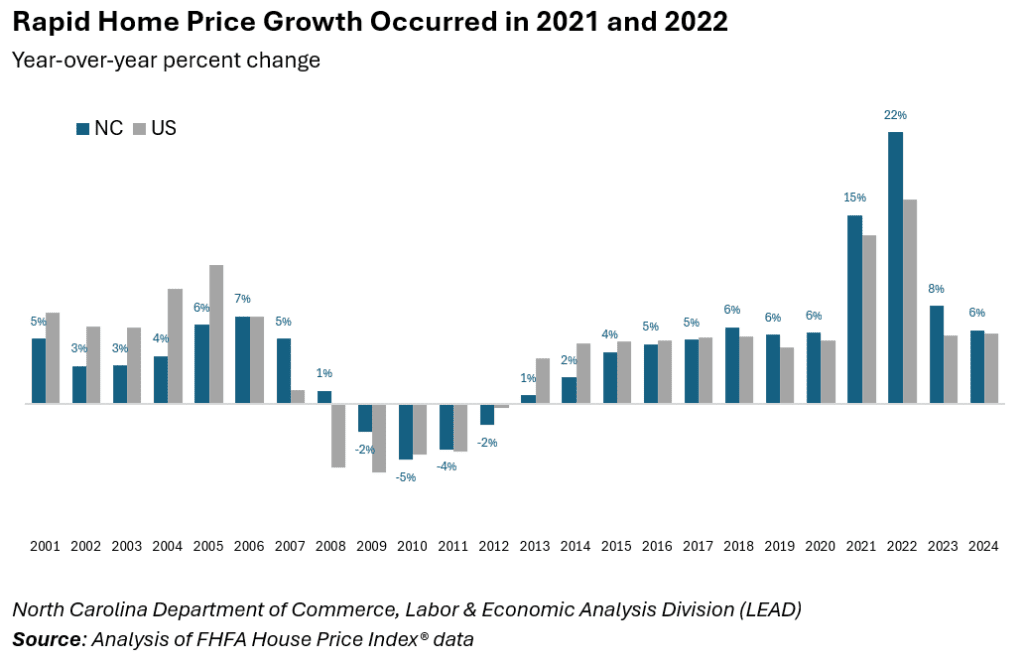

Data shows that purchasing a home is a smart investment. That’s especially true in North Carolina, where continued population growth is spurring an additional need for housing in a low-inventory market. Data from the North Carolina Department of Commerce shows that homes appreciated more than the national average every year since 2018.

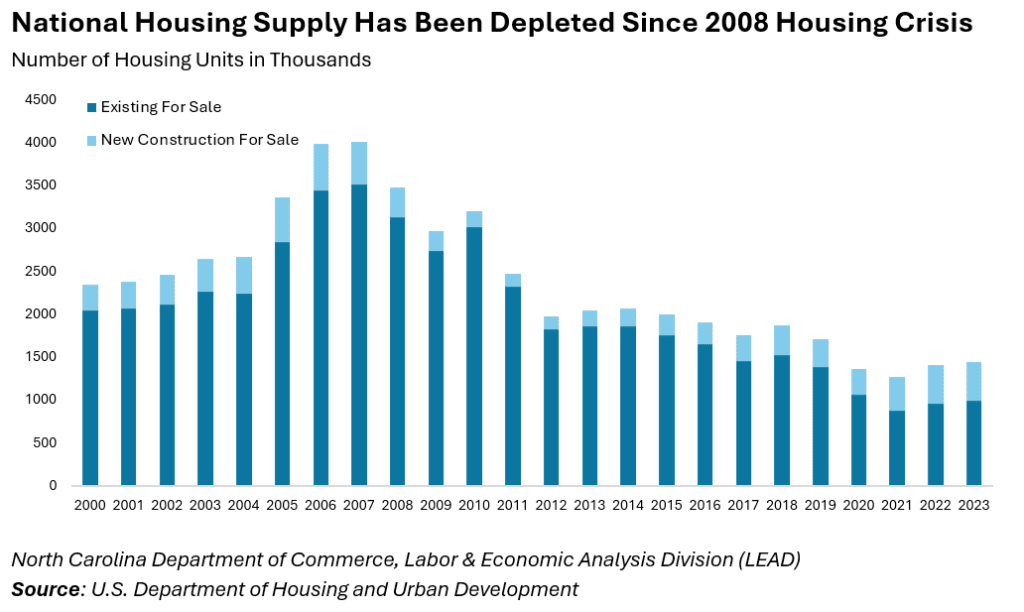

Yet the housing supply has never rebounded from 2008. New home construction and resale inventory haven’t kept pace.

Things are slowly starting to change in regards to the area’s housing supply. DoorifyMLS shows active inventory is steadily increasing in the Triangle. However, there’s still significant work to be done to increase the supply of homes in the region. If you’re interested in buying, the key is to plan early and act quickly to find a home for your needs.

6 tips to compete as a homebuyer in North Carolina

As housing inventory numbers climb in the Triangle, it’s a great time to consider entering the market. But to get competitive, you need to follow the right strategy. These tips for North Carolina homebuyers can help you get ahead as you hunt for your next home.

1. Get pre-approved if you’re thinking about buying

Getting pre-approved for a mortgage is more than just checking a box. It’s about building the right team and strategy from the start. A mortgage lender should act as a financial partner, not just someone who hands you a letter. Finding a trusted local lender who knows the Raleigh and North Carolina markets can streamline the process by working seamlessly with your agent, attorney, and inspectors. Unlike online applications, a good loan officer takes time to understand your financial picture, long-term goals, and what monthly payment fits your lifestyle, setting you up with a plan that makes you a stronger buyer.

It’s never too early to get pre-approved. In fact, the sooner you start the pre-approval process, the better. Starting early gives you time to improve credit, reduce debt, and prepare for a purchase months in advance. That way, if the perfect home appears sooner than expected, you’re ready to act. In addition, a thorough pre-approval isn’t just a piece of paper. It signals to sellers that you’re a serious, financially solid buyer. By having open conversations with your loan officer and revisiting your approval as circumstances change, you avoid surprises and present the strongest offer possible in today’s competitive market.

2. Work with a highly experienced, local real estate expert

In many of the communities found within the greater Triangle area, homes may sell in a matter of days. That’s why it’s critical to have an experienced real estate professional on your side. Having a local, highly experienced agent who knows neighborhood trends, builder reputations, and hidden opportunities is invaluable. Local agents often hear about listings before they hit the market, and they can help you discover hidden gems and up-and-coming neighborhoods.

Finding the right real estate professional is all about trust, research, and fit. Start by asking friends and family for referrals, since personal recommendations often reveal how an agent truly works with clients. Then, do your own homework. Check their website, social media, and online reviews to see their track record. Interview agents to understand their availability and experience. And ask for references to get detailed insight into past client experiences. The right agent will advocate for you and guide you confidently through the buying or selling process.

3. Act quickly and decisively

When inventory is tight, hesitation can cost you the home. Whether you’ve found a single family home in Cary, a condo in downtown Raleigh, or a townhome in Garner, if it checks your boxes, be ready to make an offer fast — sometimes the same day it lists.

This is why it’s so important to get pre-approved. When you’ve worked in advance with your lender, you know your budget, and you have that paperwork lined up, you can make an offer in confidence. It’s always wise to make a wish list to help you whittle down what is most important in your home search. Be sure to share that list with your agent so they can look for and make recommendations on the homes that check those boxes.

4. Make a strong, clean offer

In a seller’s market like the Triangle, it’s important to make a solid offer from the start. Homes aren’t sitting on the market long, which means it’s smart to offer competitive pricing up front. You’ll want to provide a number that gives you the best price possible without lowballing and taking the chance of losing out on the opportunity.

You’ll need to weigh additional details in your offer, too. For example, if you can limit the number of contingencies, or “escape clauses” you put in the offer, it can help the seller feel more confident in accepting your offer. Consider what you can provide for due diligence or earnest money, which can help the seller see that you’re serious. You can also provide flexibility on closing dates, which can be attractive to sellers. The more straightforward the offer, the more likely a seller will be to accept it.

5. Explore new construction communities

New construction is booming in the Triangle. Builders of all backgrounds and price points are adding new homes in neighborhoods across the region, designing them with modern floor plans and energy-efficient features. And some are even offering buyer incentives to help sweeten the deal. Exploring new construction means you may avoid bidding wars altogether and secure a home on your timeline.

The great news about new construction is that there are several ways to get into a new home. Many communities have standing inventory for sale, which provides the opportunity to move fast and with ease if you want a brand-new home on a fast timeline and don’t need customization. Pre-sale homes, meanwhile, allow for greater personalization of finishes, floor plans, and design, though they require a longer timeline and a higher upfront deposit. If you have time on your side, you can look for a builder and fully customize a home to your needs. New construction is a great way to find a home fast or to ensure you get the exact home you’re looking for.

6. Stay flexible on location

One of the final tips for North Carolina homebuyers is that if your budget is tight, expand your search radius. Areas like Angier, Clayton, and Youngsville offer excellent homes at a lower price point than central Raleigh, while keeping you connected to Triangle job hubs.

In fact, in communities on the outskirts of the Triangle, you can often find more home for your money without sacrificing convenience. And right now, you can even find great incentives that can help you get into the right home. Being open to new locations and up-and-coming communities can help you secure a great home for your needs.

The bottom line

Competing in a low-inventory market requires preparation, speed, and flexibility. By securing financing early, working with an experienced North Carolina real estate professional, and staying open to new construction or up-and-coming neighborhoods, you can find the right home, even in a competitive market. Use the above tips for North Carolina homebuyers to help you get ahead of it all.

Be the First to Know

Want to get the latest from The Jim Allen Group’s trusted local experts?

Subscribe to our blog, and we’ll notify you when we post something new!